If you’ve been following me on LinkedIn for a while, you know that there’s one thing I’m passionate about exploring - how PR can unlock investment.

I’ve recently been diving into the data which shows exactly that. And if you missed my related posts, you can find that analysis here.

In short: I found that securing coverage is strongly linked to fundraising.

Timing is important. I learned that it takes around six months for a PR campaign or push to translate into investment. That means planning early - often up to twelve months ahead of your raise or investment round.

The other important point to consider: looking at the data I found that securing coverage not only increases the rate of investment, but the amount too. I found that companies were initially able to raise small amounts here and there, but once their PR campaigns kicked off, the investment value rose.

But what about the other side of the equation? What happened to the companies that didn’t focus strongly on securing coverage? Were they still able to find success, or was it a limiting factor on their fundraising efforts?

That’s what I wanted to find out next. So here’s my deep dive into biotech startup failure.

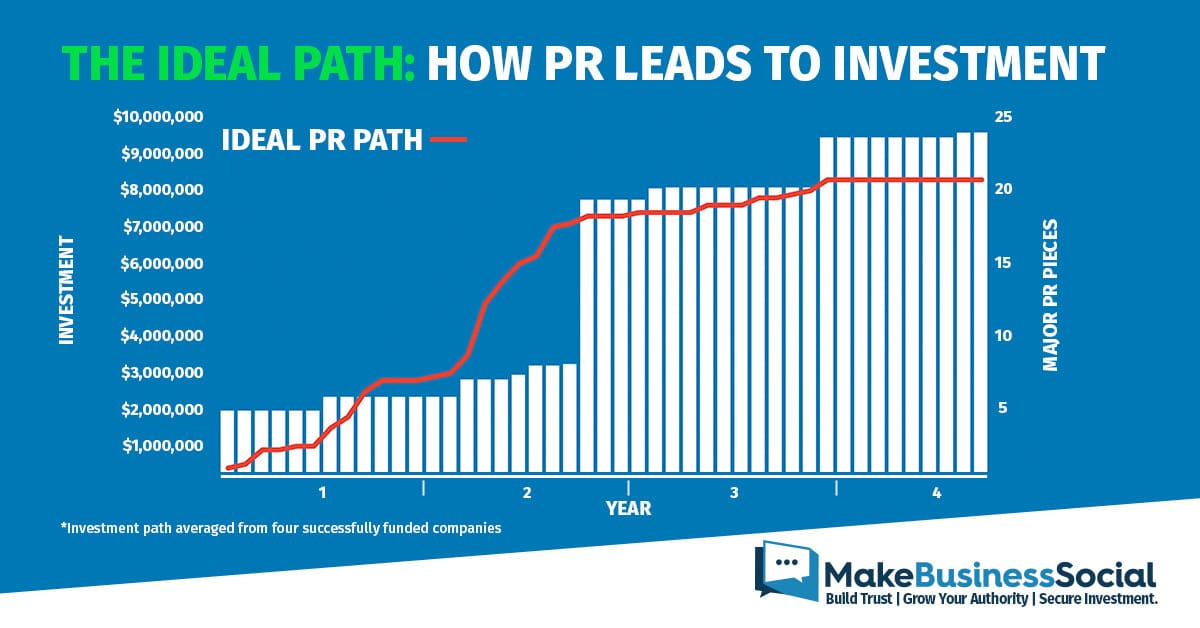

The Ideal Path

I wanted to have a marker against which to measure the relative success and failure of any given company. So I charted the course of the successful startups I had measured (find the link to that analysis here!) and averaged out their investment journeys to produce the ‘ideal path’ to funding.

It’s important to note that of course, this isn’t the only path available to fundraising success.. But it is a representation of how PR can supercharge your fundraising efforts.

You can see towards the end of year two the way that the average funding levels climb sharply. Until that point, the media coverage has always preceded funding rounds - but by then, the startup has generated enough buzz to keep the ball rolling.

So while it’s not necessary to follow this route, it’s a great example of just how much of an accelerator PR can be.

With this ‘ideal’ path in mind, I turned to some failed startups to investigate what went wrong.

Taka Apps

Founded back in 2017, Take Apps were attempting to gamify digital therapeutics for people with limited movement. Their idea was to give a neural-level workout for the brain circuits controlling movement using personalised games.

In January 2018, Taka saw an initial investment of $30,000 in a pre-seed funding round. And… that was it. No investment followed after that, and the company coasted to failure after four years in operation.

It’s clear why: they didn’t secure any coverage in this time. There was no buzz about their product, and that meant that they were unable to get any traction with investors.

That’s not to say they didn’t try to secure coverage. We can only measure the impact of a campaign that was successful. But if they did try, it didn’t work.

And it’s important to remember - PR isn’t easy! It takes considerable planning and time to build relationships with media. There is a risk of failure, and you will need to retreat, rethink, and re-strategise.

It’s no slight on Taka that they didn’t make it. But it does show you how important it is to develop that early noise and energy around your product.

MyBumpy

MyBumpy wanted to create the ‘most sophisticated pregnancy app on the planet’, delivering obstetric and maternal-foetal advice, content and help to expectant mothers. They received a modest investment of £50,000 at the beginning of their third year, but after this they weren’t able to secure anything further - and after four years, they had to close.

The path to failure is clear, and reminiscent of Taka’s: they didn’t achieve the coverage, and so their investment strategy failed.

Today, PR isn’t just about generating headlines. While the impact can be harder to directly measure, a strong social media brand and presence is also an important part of your overall strategy. Take a look at their now-defunct Twitter account: https://twitter.com/MyBumpyApp

It’s pretty sparse - and most of what is there is reposted content from other people. No clear voice, no brand identity, no leadership. I’m wary of drawing too much from this, but I suspect it’s reflective of their overall approach to PR - and goes some way to explaining their failure.

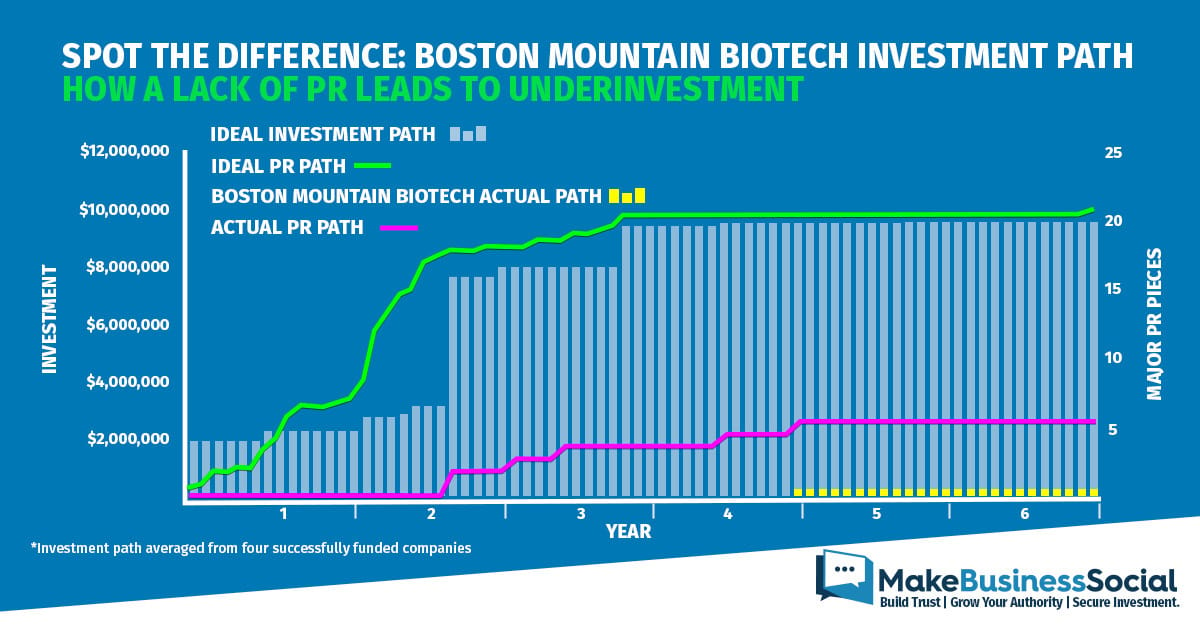

Boston Mountain Biotech

Next up I looked at Boston Mountain Biotech, a research firm focused on pharmaceutical manufacturing. You can see straight away from the graph that Mountain Biotech took an interesting path before they closed in 2022. Unlike Taka and MyBumpy, they did manage to achieve a few major PR releases after their period of initial investment.

But it clearly wasn’t enough. Towards the end of year four they were able to raise around $270k, which kept them going two extra years, but they eventually ran out of steam.

What’s striking here is that the moment they secured that investment, their PR efforts flatlined. They’d put in a lot of work in those first few years, but just when things were taking off - they took their foot off the accelerator.

It’s easy to think that the job is done once you’ve had a few hits and that first investment round comes in. But success in this context is never ‘one and done’. There’s always another exciting project for investors to look at, always a competitor at your heels, failure and success hanging over you in equal measure.

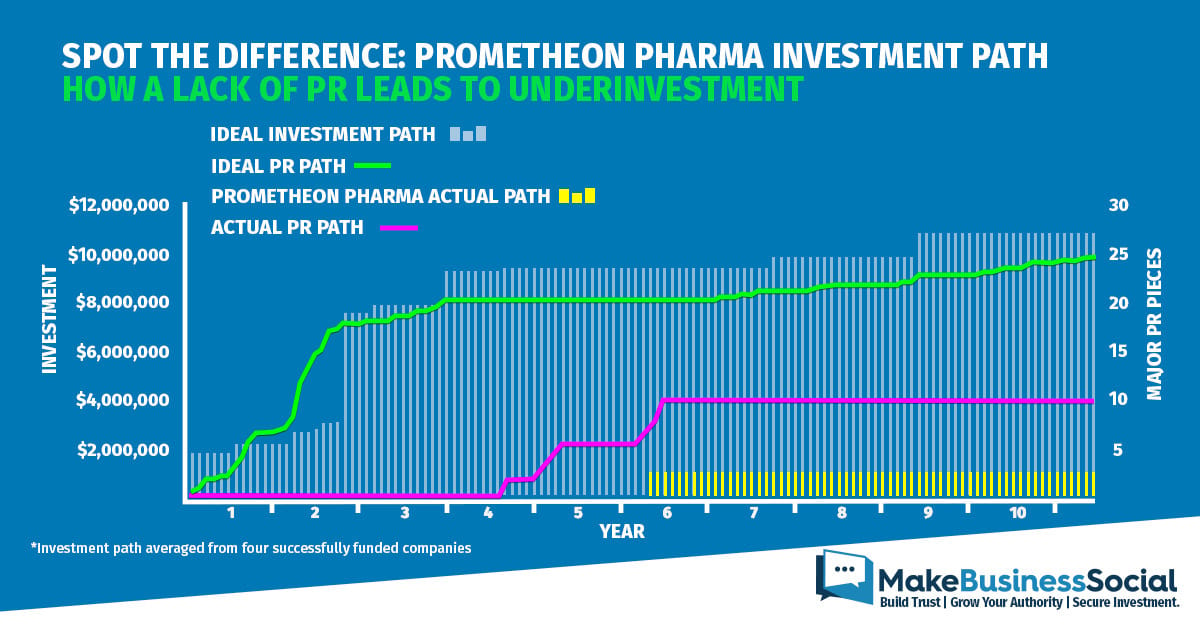

Prometheon Pharma

Prometheon Pharma was a biotech that focused on needle-free transdermal patch delivery of large molecules. They were hoping to innovate in painless delivery of insulin, hair growth products, and vaccines.

Like Boston Mountain Biotech, Prometheon clearly took their PR seriously - ultimately securing 10 major PR pieces. And you can see that it took some time to pay off - they started to gain coverage in the middle of year four, and secured a $1.1m investment in the middle of year six.

But like Boston Mountain Biotech, they allowed their efforts to flatline once that investment started to flow. For the next four years, they didn’t secure any major PR coverage - and their investment collapsed too.

It’s easy to think four years in that you’ve finally secured some buzz, and that things will be easier from there. But this assumption can be fatal. Investment is a constant fight for more.

My Key Takeaways

All of these companies had different paths, and failed for a variety of reasons. But the fundamental cause of all failure is that they ran out of money.

It’s easy to assume that these companies didn’t have strategic or any approach to PR in place, but the likelihood is that they tried and simply weren’t able to break through.

Strategically targeted PR is your best bet at breaking through the noise, which means that knowing who your audience is and what they want to hear is worth its weight in gold.

My view is that your PR and story should be laser-focused on investors - they’re the ones that determine whether your project lives or dies.

Heed the warning of these failed companies. Invest in strategic PR, early, and you’ll have a much greater shot at achieving the results you need.

Until next time,

Chris

If you’re looking to raise yours, your team’s and your company’s investability, I can help.

My work focuses on helping CEOs, founders and management teams increase their visibility and build their authority in their space, supporting their fundraising and investment goals.

Just reply to this email, or DM me on LinkedIn, and let’s have a conversation.