You probably know by now I am pretty zealous about my belief that good, planned PR is essential for successful fundraising in the bio- and healthtech space.

It’s easy to make the argument. It’s logical, and it feels like common sense.

The more visible you are - and seen as trustworthy, knowledgeable, and forward-thinking - the more likely investors are to invest in you and your business.

But - that argument isn’t backed up by hard data.

And the issue is, founders need more than words to persuade them.

They hear dozens of voices every day - marketing agencies and PR specialists telling them that if only they work together, they’ll be guaranteed success.

And those voices all sound convincing. So founders need hard data to guide them in the right direction.

While I strongly believe in the power of PR to secure investment, I also want to put my money where my mouth is and show you the link between PR coverage and fundraising success.

So with that in mind, I investigated four successful bio- and healthtech startups, and here’s what I found.

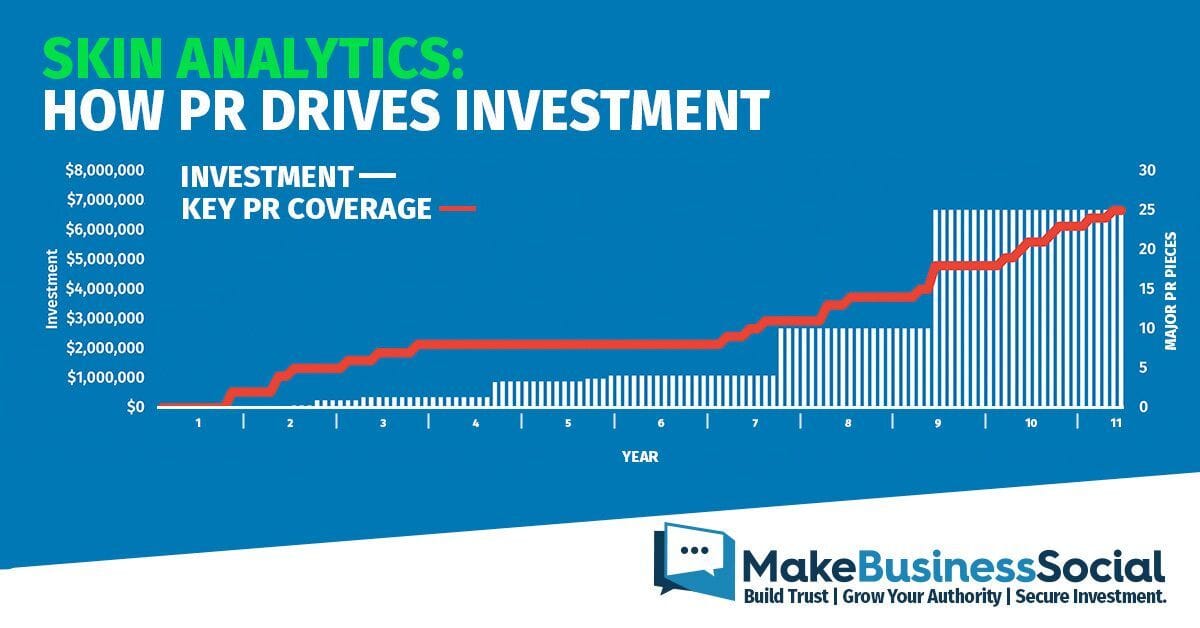

Skin Analytics

Founded in 2012, Skin Analytics uses advanced imaging algorithms to detect skin cancer. Their 10+ year funding journey was a great place to start because it allowed me to identify trends developing over the long term, as opposed to just a couple of years.

And the trend is clear - significant PR coverage* closely correlates with their fundraising.

In Skin Analytics’s case, it took almost two years before they gained their first investment, but they’d already begun generating press coverage before that.

And it’s notable that there was typically a spike in coverage a few months before each funding round.

Yes, it’s logical, but this data showed me that PR coverage doesn’t drive immediate impact.

Instead, it’s critical for getting the ball rolling as the company is actively working on a funding round, building awareness and visibility. It helps investors get a clearer sense of who the company is and why they should invest.

Thinking about it another way - rather than asking investors to say ‘yes’ straight away, good PR can build anticipation and a picture of the company and founders in the eyes of the investor months before the fundraising round kicks off.

Zetta Genomics

Zetta Genomics is a data tech company based in Cambridge, helping providers tailor their medicines more precisely. Their PR journey has been steady - with coverage slow to begin and then gradually rising across their first six months before experiencing an uptick towards the end of their first year.

It took Zetta Genomics over a year to secure a second investment. Once again, it’s interesting to note that an uptick in PR coverage came about six or seven months before the funding event.

The evidence so far strongly suggests to me that planning and timing is just as important as the press coverage itself. Making the assumption that it takes six months for your company to get traction from PR, you should be thinking about your PR planning 8-12 months in advance of fundraising.

Good PR doesn’t just happen - it takes a lot of hard work and careful planning to see success!

Vinehealth

Vinehealth was founded in 2018 and uses AI and other technologies to improve survival rates and the quality of life for cancer patients.

They follow a similar journey to the other companies I looked at, with their early PR efforts securing initial interest and leading to their first funding. In fact it’s clear that in their first year Vinehealth put a concerted focus on PR, securing over ten major pieces.

But the data point that’s of most interest to me is the way that Vinehealth’s PR efforts flatlined over the course of their second year, which correlates with a two year stagnation in fundraising. While they did secure some more investment early in their second year, it was not a step change from what they’d raised before.

Their next PR effort towards the middle of their third year secured them further coverage and revived their fortunes. And once again, around six months after that media push, they secured a massive $5.5m investment - over three times their initial investment!

Vinehealth is a great example of both the positive effect of PR, and what happens when you don’t sustain a focus on securing press coverage.

Lindus Health

Lindus Health is a CRO that runs clinical trials for the health and biotech companies.

Like other examples here, their PR coverage - and their investment - remained pretty flat during their first year. But media coverage began to make a sharp, sustained climb at the beginning of year two, with the firm securing several key articles every month.

And guess what? Seven months after that climb began - they received $18m in investment, rocketing past their previous $5m, and dwarfing the (relatively) small $0.44m and $1m investments they had received in the months before.

To me, this is yet another example where PR coverage didn’t just lead to investment, or speed up fundraising - it precipitously increased the level of investment.

This suggests to me that PR is worth its weight in gold, accelerating fundraising efforts and driving up investment levels.

What Does The Data Mean?

The data points I looked at gave me two main takeaways.

The first was about timing and planning. It takes around six or seven months for a concerted PR effort to pay off, and this means that you need to take this timescale into consideration when planning to raise funds.

On the flip side of that - it takes months of planning and work to get a good PR campaign off the ground and to start seeing results. So leaving a year from inception to successfully closing a funding round seems like a good rule of thumb.

My second takeaway was the way that PR influences not only the rate of investment but the amount of cash businesses actually raise. The companies I looked at appeared to raise small amounts here and there for the first couple of years, before seeing their fundraising efforts spike after a successful PR campaign.

This suggests to me that investing in PR literally pays dividends (!) and is one of the most cost-effective levers a startup can pull.

There will be a wait to see that success. But like everything, the best time to start was a year ago. The second best time is right now.

Until next time,

Chris

* ‘Significant PR coverage’ value was derived from number of backlinks to the company website with a DA >20 and does not represent total pieces of media coverage. Investment events were taken from analysis and Crunchbase data.

—

If you’re looking to raise yours, your team’s and your company’s investability, I can help.

My work focuses on helping CEOs, founders and management teams increase their visibility and build their authority in their space, supporting their fundraising and investment goals.

Just reply to this email, or DM me on LinkedIn, and let’s have a conversation.